Company Overview

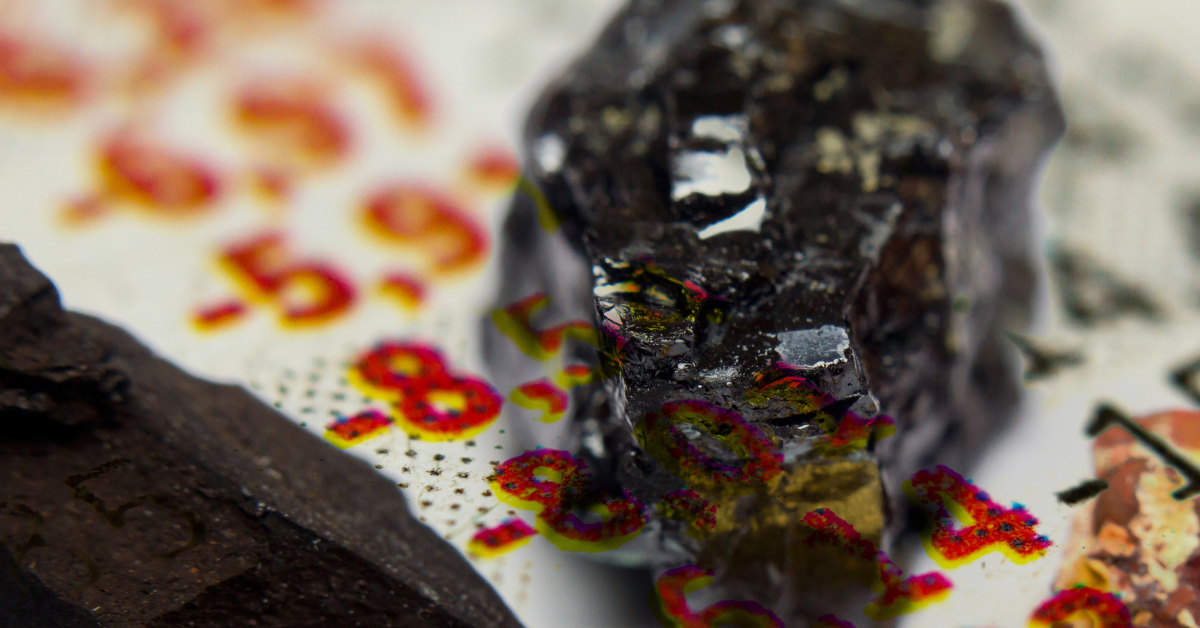

Cokal Limited is an Australian coal exploration and development company focused on identifying and developing coal within Indonesia. The company’s flagship project is the Bumi Barito Mineral project, a metallurgical coal project located in Kalimantan, Indonesia.

Financial Performance

For the full year of 2023, Cokal reported a net loss of US$9.27 million, which marked a 30% widening from the previous fiscal year. The loss per share also deteriorated further to US$0.009 from US$0.008 in FY 2022. Despite these challenges, Cokal’s earnings per share (EPS) managed to exceed analyst expectations, though revenues fell short, missing analyst estimates by 99%. The revenue shortfall was primarily driven by its Australia segment, which contributed US$14.2k, constituting 87% of total revenue. The cost of sales stood at US$2.52m, significantly impacting the earnings. Looking ahead, Cokal’s revenue is expected to grow 42% per annum on average over the next three years, surpassing the 3.3% growth forecast for the Metals and Mining industry in Australia.

Market Analysis

Cokal has seen its market cap fluctuate, indicating market responses to both its operational updates and industry trends. The past year has seen a 42.9% decrease in its share price, reflecting broader market sentiment and operational challenges the company faces. However, Cokal’s focus on metallurgical coal development in Indonesia positions it within a critical supply chain for global steel manufacturing, suggesting potential for future growth if it can navigate its current challenges successfully.

Investment Risks and Opportunities

Cokal’s financial performance shows a company navigating significant challenges, with declining earnings and revenue growth rates lagging behind the industry average. The company’s revenue and earnings have declined by 16.5% and 29.3% per annum, respectively, over the past five years. These figures highlight the operational and market challenges Cokal faces, including the high costs associated with coal exploration and development. Despite these hurdles, the projected revenue growth and strategic focus on metallurgical coal provide a basis for potential future success.

Conclusion

Cokal Limited’s journey through the 2023 fiscal year underscores the volatility and risks inherent in the coal exploration and development sector. While the company faces significant challenges, including widening losses and revenue shortfalls, its strategic positioning within the metallurgical coal market offers potential growth opportunities. Investors and stakeholders will need to closely monitor Cokal’s operational progress and market trends to understand its future trajectory within the competitive landscape of the global coal industry.