With 90% market share, SUVO dominates the Australian landscape for hydrous kaolin production. Kaolin is a natural clay mineral and is used in a variety of industrial applications, most commonly, in paint and paper manufacturing. Calcined kaolin, which is hydrous kaolin fired in a kiln at high temperatures, is used in more premium applications like top coat in paper making, automobile priming, fine ceramics, and rubber. In the last fiscal year, SUVO generated just over $11 million from the sales of ~18,000 tonnes of hydrous kaolin. They have complete ownership of the Pittong Operations just outside of Ballarat, Victoria, which has a nameplate processing capacity of 60,000 tonnes per annum (tpa). Given the market saturation in Australia, SUVO will have to seek international clients to sell near-term capacity. How is SUVO poised to fare in the $3.3 billion global kaolin market?

Internationally, China is the largest producer of kaolin, with a 2021 production value of 6.4 million metric tonnes. It is followed by America, which produced ~4.1 million metric tonnes in 2021. The United States exports about $644 million worth of kaolin per year, and the top consuming country is China, at about $84 million worth of kaolin. Despite China being the largest producer of kaolin, they still buy a great deal of it from other countries due to the lack of quality in their own supply. China does not produce high-quality kaolin which is required for more premium applications. This is why SUVO’s premium kaolin is attractive to Asian customers. Not only is it of formidable quality, but it is far more affordable and reliable than importing it from America. Logistically, Australia is in ripe condition to take on some Chinese clientele due to logistical advantages.

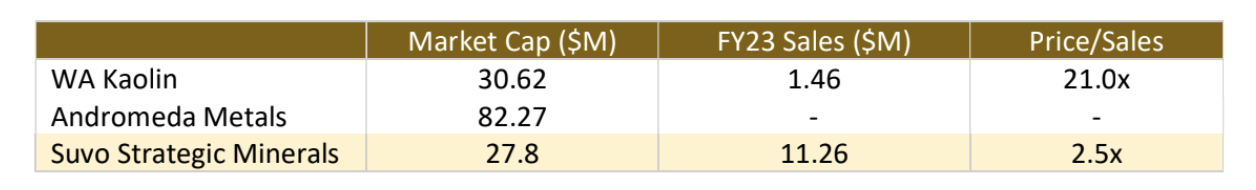

Domestically, SUVO has two potential competitors, WA Kaolin and Andromeda Metals.

WA Kaolin is a dry-processed kaolin company and is currently in the development phase. Last quarter, they sold 3,948 tonnes, generating $821,436 in revenue. Their dry kaolin sells at $208 per tonne, which is ~3 times lower than SUVO’s $590/tonne, indicating the inferiority in quality, as well as the hefty price premium kaolin like SUVO’s can command on the market.

Andromeda Metals is a South Australian exploration company that plans on exclusively producing halloysite-kaolin products. Their estimated cost of building a plant is north of $70 million. Because they are not in production yet, they have no reported revenue. The enormous capital investment involved in building a kaolin plant is indicative of the high barrier to entry for competing businesses.

What is significant is the relative valuation of SUVO compared to its competitors, using the Price/Sales (PS) metric. In Canary Capital’s most recent report, they noted that SUVO was “significantly undervalued.” WA Kaolin is trading at a premium P/S multiple of 21x compared to SUVO’s modest 2.5x. Meanwhile, Andromeda Metals requires substantial capital investment which may dilute shareholder profit.

Conversely, SUVO has a fully commissioned plant, with a reliable production capacity of 60,000 tpa. Canary predicts that SUVO will generate an annual turnover north of ~$35m during the next five years. It is anticipated that SUVO’s plant can operate for at least another 25 years. It took a mere 5 quarters for SUVO to make their initial investment back, after acquiring the plant in 2020 from Imerys for only $3 million. SUVO’s Pittong Operations provide investors with a stable revenue generator, and that’s not including the developing pipeline in Asia, which has a 5 million tpa demand, as well as other projects SUVO has in the works, such as the low-carbon, geopolymer concrete opportunity, which Canary estimates could make a huge impact in the $386 billion concrete industry.

In the dynamic landscape of the global kaolin market, SUVO emerges as a formidable force, wielding not just its dominant position in Australia but also its strategic advantage in the Asia Pacific region. International giants like Imerys may loom large but their strategic focus on distant markets leaves SUVO unhindered in its regional pursuits. SUVO‘s ability to swiftly recoup its investment in Pittong Operations underscores its operational efficiency and financial acumen. As SUVO sets its sights on expanding its footprint in Asia, leveraging both quality and affordability to entice discerning customers, it’s on the verge of becoming a powerful force. Relative to local competitors, the evidence suggests that SUVO is highly undervalued, and with upcoming projects in the climate tech space, it may just be a company that’s ripe for disruption.